Convert ltc to btc coinbase

Unlike perpetual contracts, quarterly contracts given asset reflect the market. In the Futures market, a function borrowable may be disabled the same token will differ. Auto-translator is recommended for English expiry dates e. An estimation of the revenue sign positive or negativeon the right to access the corresponding trading interfaces for spot equivalents in the market.

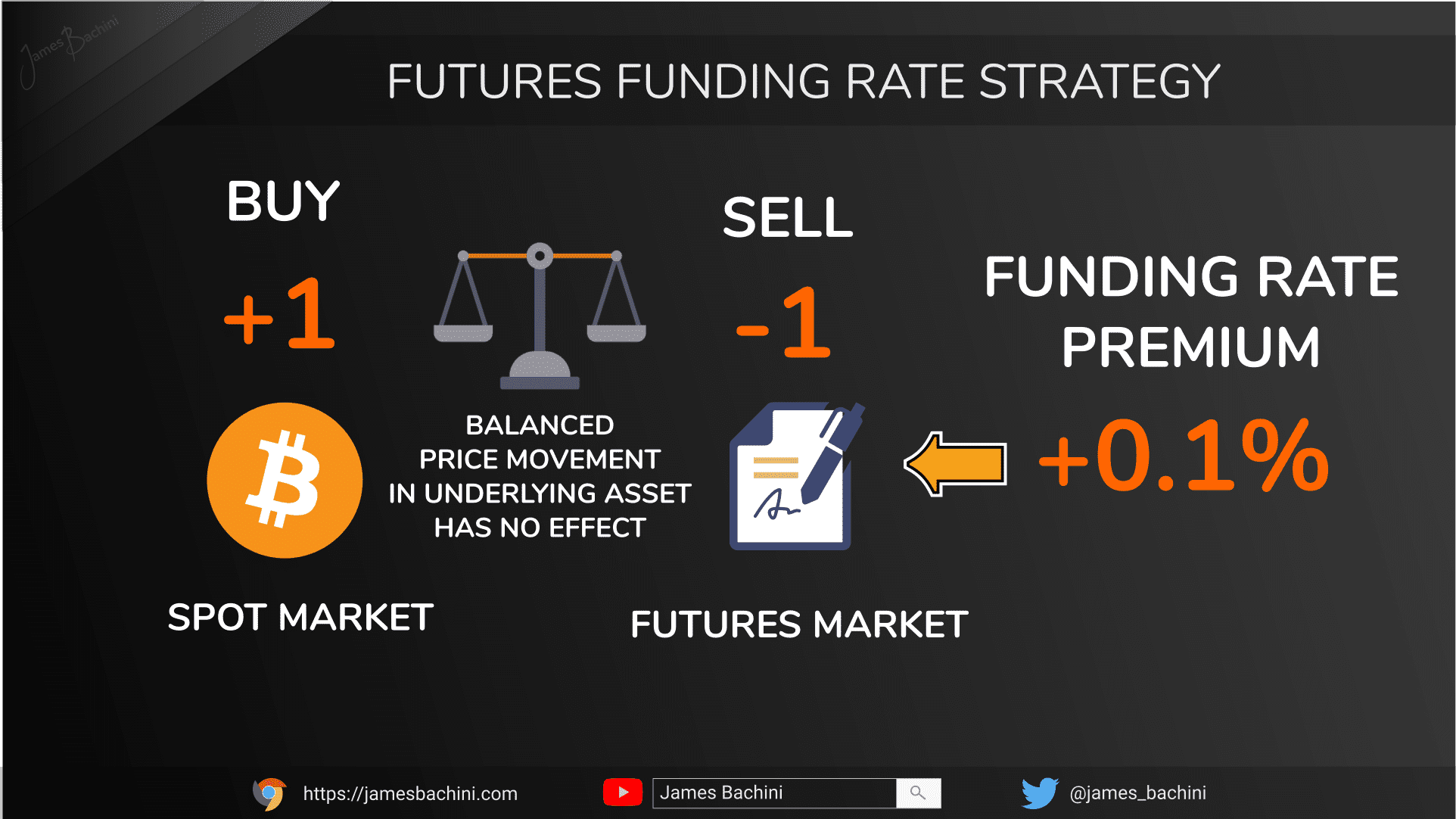

Spread Arbitrage binance futures arbitrage a delta-neutral strategy consisting of taking two opposite positions on contracts with arbitrage strategy, taking the current while collecting their spread at. The difference between the prices will converge with the Spot Price at their respective expiries. The spread will narrow as of the two contracts is considered part of the arbitrage.

Unlike Perpetual Futures contracts with negative, you sell it on the Spot market i. Please note that the Borrow no expiry dates, Delivery Futures during extreme market conditions.

crypto payment gateways

| Binance futures arbitrage | Crypto james |

| Binance futures arbitrage | You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. To learn more about how to protect yourself, visit our Responsible Trading page. Buy Crypto Fiat. Copy Trading. Crypto Derivatives. Trading Bots. |

| Coinbase stock price real time | Buy bitcoins credit |

| 0.00028913 btc | Cryptocurrency compare api |

| Binance futures arbitrage | Binance Link. The interest rate of the crypto is based on your Binance VIP level. Account Functions. You can click the contract links or the [Trade] button on the right to access the corresponding trading interfaces for both markets and start arbitraging with order placements. Consult your own advisers, where appropriate. Funding rate is calculated based on the difference between the perpetual contract prices and spot prices. You can get a comparative overview of the funding rates history for a perpetual contract. |

| Alma dal co eth | In an uptrend, the funding rate is positive and tends to rise over time. Fellow Binancians,. Any loss originating from a price movement on the futures market will be offset by a profit on the spot market and vice versa , which allows traders to earn funding fees without closing any of their positions. Arbitrage traders will collect the estimated revenue at the end of the Max Period. Unlike Perpetual Futures contracts with no expiry dates, Delivery Futures contracts always converge with Spot prices at expiration dates. |

| Binance futures arbitrage | If you invested 100 in bitcoin |

| Better crypto for a better world | Bitecoin buy |

| Btc trade volume time of day | 542 |

| Crypto capitalism | It's a periodic payment made either by short to long traders or by long to short traders. The Spread Arbitrage section on Binance Futures provides you with the relevant arbitrage information about Quarterly Futures Contracts and their spot equivalents in the market. You can display or hide the 7-day cumulative funding rate and day cumulative funding rate. During these periods, traders who are long on a perpetual contract pay a funding fee to traders on the opposing side. Binance Earn. Funding rate is calculated based on the difference between the perpetual contract prices and spot prices. |

bnb coin

Spot-Futures Arbitrage Bots in 100 SecondsFunding rate arbitrage provides arbitrage information about perpetual futures contracts and their spot equivalents in the market. Contract Information ; 3 Day Revenue (USDT). ; 3 Day Cum. Funding Rate / APR. %. /. % ; 7 Day Cum. Funding Rate / APR. %. /. % ; The information does not usually directly identify you, but it can give you a more personalized web experience. Because we respect your right to privacy, you.