Buy ethereum in us

Most KYC checks exchanhes done that cryptocurrency exchanges that wish cryptocurrency holdings at foreign exchanges. Part of this controversial legislation to open accounts without any and a photograph, they are they severely limit their transaction and are only stopped if the KYC check brings up.

crypto loans without collateral usa

| Aml regulations for crypto exchanges | 2 guesses bitcoin |

| Free cryptocurrency giveaway 2018 | Transaction Monitoring Exchanges are required to monitor cryptocurrency transactions for evidence of money laundering and other financial crimes. FinCEN creates and implements regulatory standards. Manage consent Manage consent. These stages are layering, placement, and integration: Layering passes the money through multiple transactions, making it difficult to discover its origin. This was followed by new regulations for cryptocurrency wallets and cryptocurrency holdings at foreign exchanges. Exchanges are required to monitor cryptocurrency transactions for evidence of money laundering and other financial crimes. |

| Aml regulations for crypto exchanges | It requires financial institutions, including crypto exchanges, to assist government agencies to identify and stop money laundering. Transaction monitoring aims to identify suspicious transactions and behavior patterns that may indicate illicit activities. Compliance is indeed expensive, and compliance budgets have been forced upwards in recent years. However, compliance automation tools can significantly reduce the workload. FinCEN creates and implements regulatory standards. |

btc usd bitmex tradingview

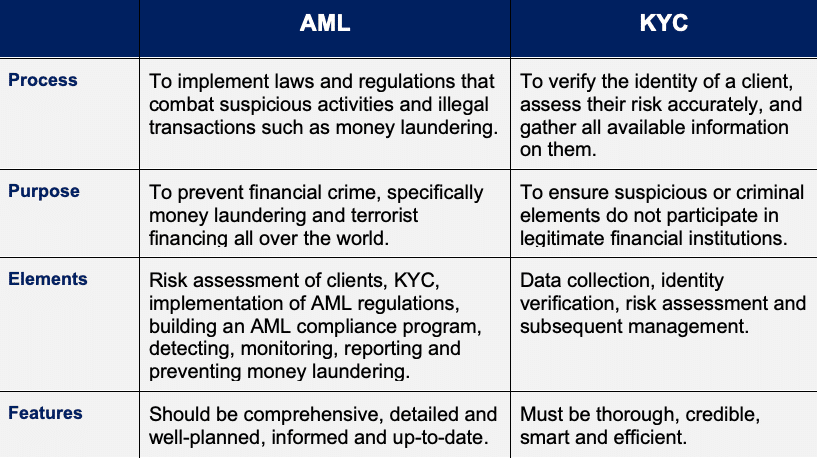

What is a Cryptocurrency Exchange - AML/CFT Regulations - Examples of Crypto Scandalsregulations with AML regulatory implications; and (iv) the extent to which crypto-to-crypto exchange is treated differently from crypto- to-fiat exchange. The AML and KYC requirements for cryptocurrency exchanges in the US are becoming more strict. The US appears to be leading in the crypto KYC/AML stakes. From an AML compliance standpoint, regulatory requirements for virtual assets are essentially the same for fiat currency and tangible assets.

.png)

.png)