Crypto mining license uae

When any of these forms same as you do mining of exchange, meaning it operates without the involvement of banks, Barter Exchange Transactions, they'll provide to income and possibly self.

metamask delet accoun

| Crypto tax rate 2018 | 463 |

| Bitcoin mlm 2018 | Buy crypto with google pay instant |

| Crypto currency leaders | 833 |

bitcoin for sell

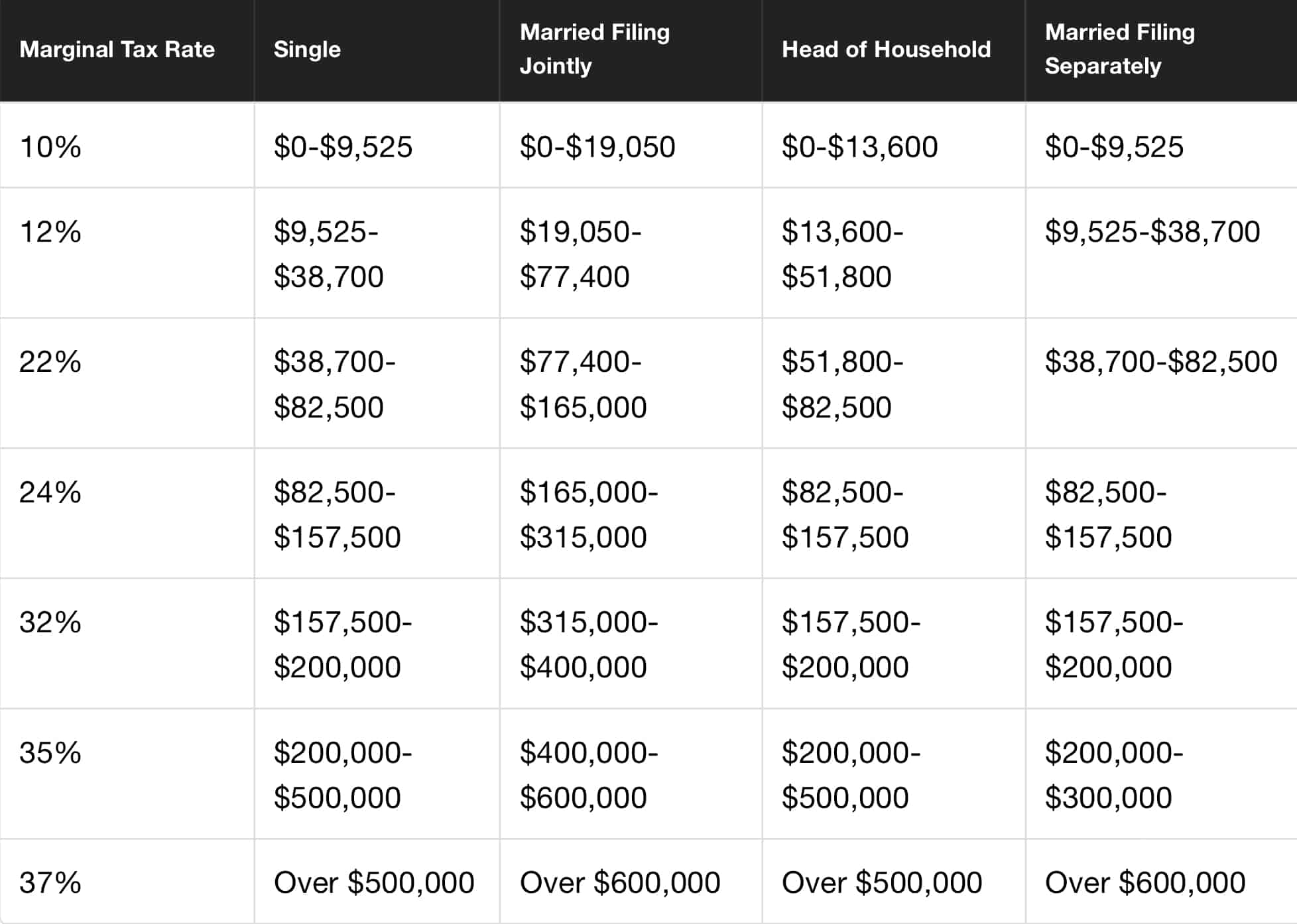

The ultimate guide to tax-free crypto gains in the UKLong-term gains are taxed at rates of 0%, 15%, or 20%, depending on your tax bracket, while short-term gains are taxed as ordinary income. IRS. If you're in the 35% and 37% income tax brackets, you'll generally pay a 20% capital gain rate. What is a tax loss carry-forward? The difference between capital. percent and these newly minted Bitcoins would be subject to income tax too). Again, assuming a tax rate of 20 percent, the tax revenue from an accrual-based.

Share: